A keen overdraft was a means of credit in your family savings

Overdrafts are supplied in your latest account to ensure, when your balance was zero, you could potentially however purchase as much as an agreed restriction. Overdrafts often have a high interest than just personal loans however, are flexible and certainly will be useful getting quick-identity borrowing and you will apparently lower amounts.

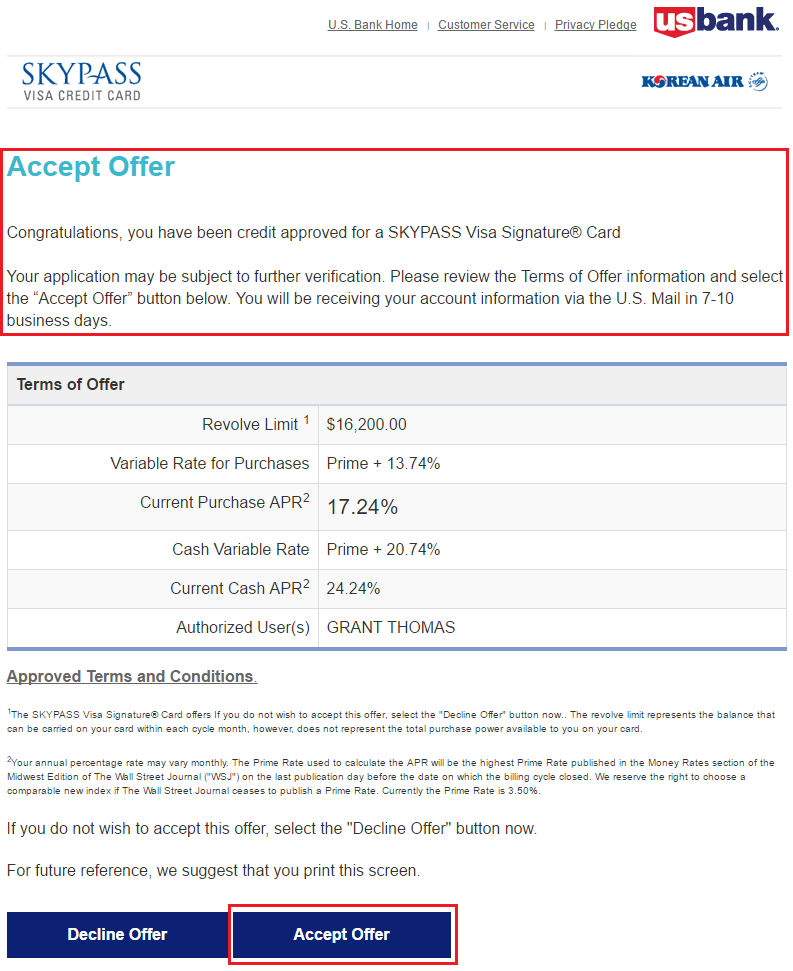

Credit cards

![]()

A credit card makes you use a restricted add up to pay money for goods and services. There is no attract billed towards the borrowings for those who pay their complete bill contained in this a-flat level of months.

Playing cards are versatile and will be used to pay for factors and properties that you may possibly get online otherwise by cellular telephone. Credit cards is actually approved to fund goods and services otherwise to find bucks.

The newest CCPC features a charge card assessment product that shows the fresh new interest rates billed for different playing cards available.

Unsecured loans off banking institutions

Banking companies render personal loans in order to users. This type of finance was right for average and offered-title needs, such, an auto loan otherwise a loan to possess home improvements. Finance companies may also charges other fees. Fundamentally, you only pay a fixed amount right back every month.

In case the loan was a variable rates financing you are capable spend more back when you may have it, in order to repay the borrowed funds fundamentally.

Credit relationship funds

Credit unions also offer fund to help you users. You truly must be a person in a cards union before you can https://clickcashadvance.com/installment-loans-nh/ can take aside that loan. Credit unions is based in the community or work environment and you must be life style or working in a particular urban area or operating to possess a specific manager being a part. You might have to features conserved some money during the a credit union before getting financing.

Borrowing relationship finance try right for small otherwise extended-label means instance loans for holidays otherwise vehicles. They are also useful for refinancing other fund.

Certain borrowing from the bank unions provide the It’s wise loan. It financing aims at individuals delivering societal interests payments exactly who pay off the mortgage from House Funds Plan. It’s fund of a small amount on low interest.

Hire purchase

This will be a get contract supplied by shop you can hire and finally pick types of factors. Items bought towards hire purchase are typically expensive facts such as for example a vehicle or chairs or digital equipment. Into the a hire-purchase contract, you feel the master of the item in the event the history instalment is reduced.

Private Bargain Agreements (PCPs)

This will be a kind of hire purchase contract provided by auto buyers as a way to pay money for an automible. From inside the a PCP deal, you have to pay in initial deposit and you can always generate regular instalments, constantly more than three years. There clearly was usually a massive lump sum towards the bottom of your offer.

- Spend the money for latest lump sum payment and keep maintaining the automobile otherwise

- Come back the auto into provider

That you don’t individual the automobile up until the finally payment was generated. If you go back the automobile, you could potentially take out a different sort of PCP on the another auto.

PCPs can seem to be most attractive as they often have low month-to-month payments however they shall be cutting-edge compared to the other designs away from auto loan. It’s important to learn the fine print in advance of your register for good PCP. You will discover much more about PCPs regarding CCPC.

In-shop borrowing from the bank

Some shop provide the choice to purchase something and you can pay because of it when you look at the instalments. It is both named Pick Today Spend After.

You enter into a binding agreement to settle the credit merchant. It is vital to browse the fine print of your own agreement, such as the fees and charge instance attention or later fee charges. The newest CCPC features further information to the Pick Today Pay Later on.