Your entire Self-help guide to Fico scores and buying a house

Welcome to our very own complete book for the navigating the field of borrowing from the bank scores and homeownership! If you’ve ever imagined managing your house, you’re in the right spot. Understanding the ins and outs of your credit score is crucial to have reaching one to purpose and you will making sure the best money terminology on the home loan.

Contemplate your credit rating such as a financial fingerprint unique for your requirements having tall impact on what you can do in order to acquire currency, together with to own a home loan. Inside site, we will demystify the concept of fico scores, target well-known questions one to homeowners normally have, and highlight exactly how your credit score could affect all of the action of homebuying journey.

Thus, whether you’re a primary-big date homebuyer eager to grab you to monumental step or a professional homeowner trying clean through to their borrowing studies, continue reading more resources for the fresh ins and outs regarding credit ratings!

Preciselywhat are credit scores?

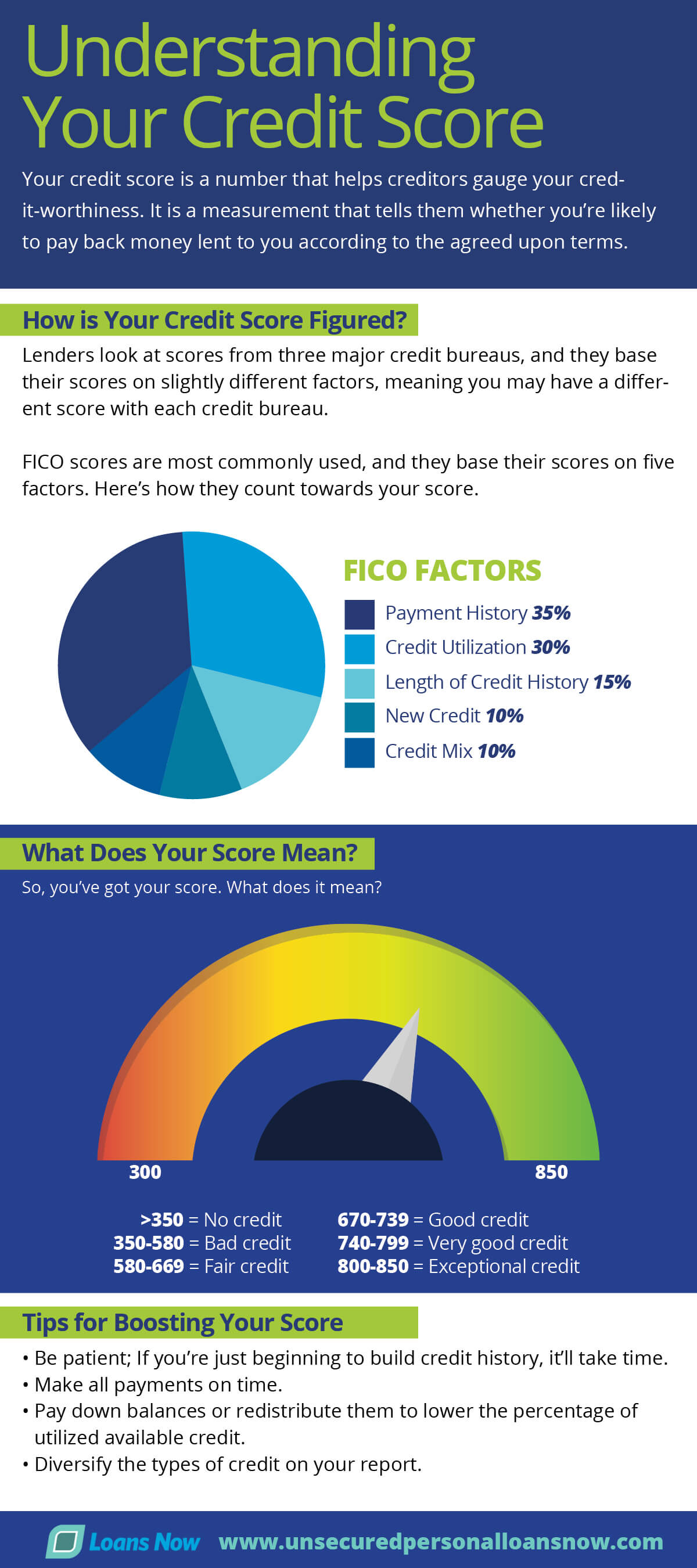

Your credit rating are an excellent around three-thumb matter symbolizing the creditworthiness and you can suggests so you’re able to loan providers how almost certainly youre to repay borrowed money on big date. Its generally a mathematical overview of your credit score and economic conclusion.

Credit scores typically cover anything from three hundred and you will 850, that have highest score exhibiting a lowered exposure getting lenders and higher creditworthiness. The better your credit score, the more likely youre in order to be eligible for good mortgage terms and conditions, such all the way down interest levels and better borrowing constraints.

What is a good credit rating?

Predicated on FICO, good credit try 670 or more. Listed here is an article on the FICO Rating ranges:

- Exceptional: 800 to help you 850

- Very good: 740 in order to 799

- Good: 670 so you can 739

- Fair: 580 so you’re able to 669

- Poor: 3 hundred so you can 579

Just how was my credit rating calculated?

Fico scores are determined centered on some issues produced by your own credit history. As specific algorithms utilized by credit reporting patterns try proprietary, they generally look at the pursuing the key factors:

Percentage background

Payment history ‘s the list of your own prior repayments on borrowing levels, for example playing cards, financing, and mortgages. And come up with your instalments punctually certainly has an effect on your credit rating, when you are late otherwise overlooked repayments can be lower it.

Credit utilization

It refers to the portion of the offered borrowing that you are already playing with. Keepin constantly your borrowing from the bank utilization lower, ideally lower than 31%, demonstrates responsible borrowing from the bank administration and will increase credit score.

Amount of credit score

Just how long you’ve been having fun with borrowing is the reason a great tall percentage of your credit rating. Generally, loan providers consider a longer credit score a whole lot more absolutely since it shows your capability to deal with borrowing from the bank responsibly and you may continuously usually.

Borrowing combine

Lenders like to see that one may create different types of borrowing from the bank sensibly, such as for instance credit cards, fees finance, and you will mortgage loans. That have a diverse mixture of borrowing profile can be undoubtedly impact your get.

The latest borrowing from the bank questions

Any time you get this new borrowing from the bank, a painful inquiry is put on your own credit report, that may briefly decrease your credit history. Several concerns within this a short span suggest you might be earnestly looking to most credit, which may suggest financial imbalance otherwise an urgent dependence on money and you will rule to help you lenders your a high borrowing exposure.

Exactly what are the different types of credit scores?

Yes! Lenders fool around with several credit reporting patterns to evaluate credit risk, however, two of the most commonly known was FICO Rating and you will VantageScore.

FICO Get

Created by the Reasonable Isaac Agency, this new FICO Get the most popular borrowing from the bank rating patterns in america. It selections out payday loans Pisgah of 300 to 850 that is predicated on suggestions on the three biggest credit bureaus: Equifax, Experian, and TransUnion. There are numerous brands of the FICO Rating customized to particular areas, like car loans, credit cards, and mortgages.