An expert Guide to Family Restoration Loans and just how Home improvement Fund Works

It comprehensive specialist book teaches your all you need to know about financing home improvements with a restoration mortgage. We’re going to as well as help you decide and that financing type of is the best for you!

A repair financing makes it possible to create exactly that. Family recovery loans certainly are the wisest way for homeowners to finance home improvements, yet , the majority of people do not even comprehend that they exists!

A restoration financing is scheduled from the you to important element: after-renovation worth. ?House recovery financing may be the Only brand of mortgage that provides residents borrowing from the bank for an excellent residence’s upcoming really worth.

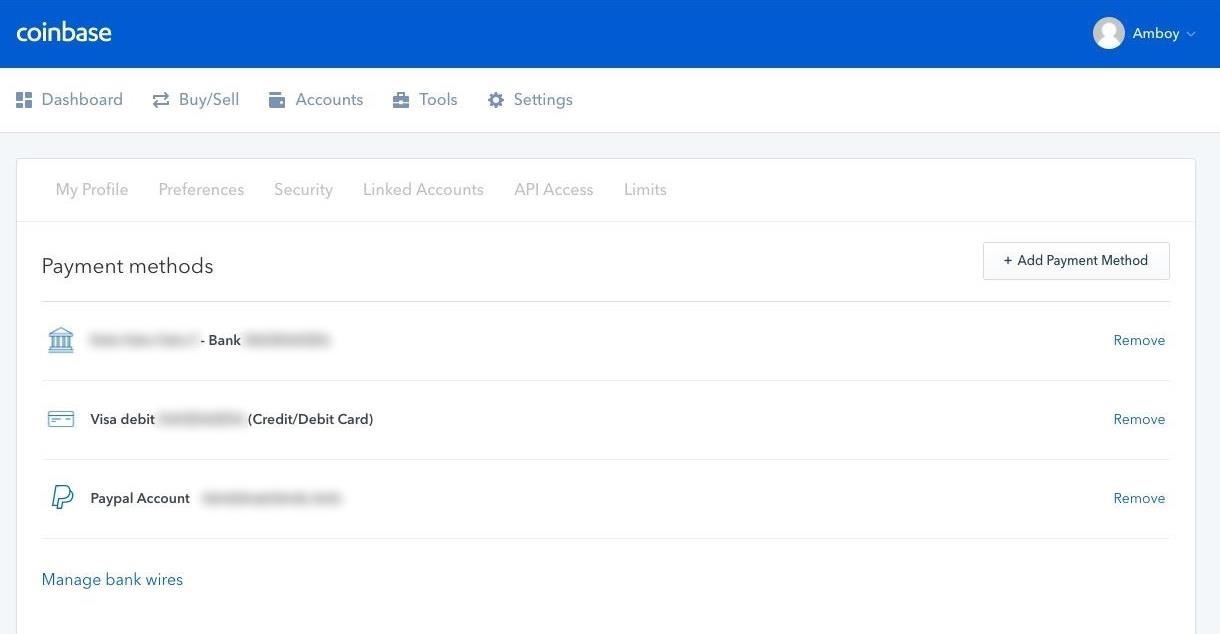

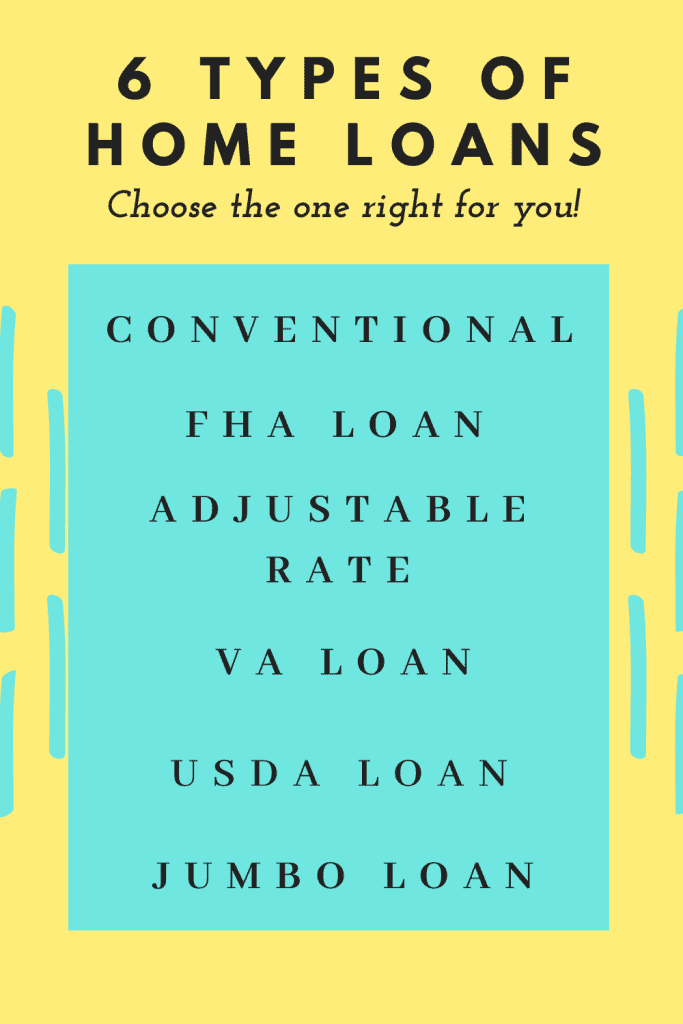

Regarding financial support your repair enterprise, it is possible to get a hold of some selection for example design loans, FHA 203(k) Loans, and Fannie mae Homestyle Fund. not, whenever you are seeking a fund solution customize-made for repair requires, look no further than The fresh new RenoFi Mortgage.

Antique loan providers reduce count you could use that have a property equity financing so you’re able to 80% LTV, while having good RenoFi home guarantee loan, you could obtain as much as 150% of the house’s most recent really worth.

The good thing? RenoFi is the Only choice one to wholly serves the credit requires out-of homeowners that simply don’t have to accept less renovations on the wishlist.

Which specialist article often explore how to make an application for repair funds, criteria, interest rates, advantages and disadvantages, and you may household renovations financing choices, and remark the best and worst home recovery money on today’s markets.

What is actually a renovation Financing as well as how Create They work?

A repair mortgage is a type of loan giving financial support specifically for home improvement methods. Domestic recovery finance enables you to loans renovations in the place of tapping into private discounts.

They work giving homeowners which have financing used to afford cost of the fresh reount is normally considering the brand new projected price of the project and you will just after-resolve worth. The loan might be reduced more a-flat time that have focus. There are two main version of home improvement loans: secured loans for example home collateral funds and you will personal loans such as for instance individual funds.

Renovation Loan Specialist Tip: You can score confused about the term home repair loan. That’s because specific circumstances offered just like the do it yourself money or repair money are actually merely renamed unsecured personal loans otherwise playing cards. All these renamed items are not true recovery money due to the fact they aren’t suitable for most repair tactics the help of its high-interest rates, smaller conditions, and you may limited mortgage dimensions. A real domestic restoration mortgage offers homeowners borrowing to have an effective house’s upcoming worthy payday loan cash advance Kittredge of and you can uses this new once-repair value to obtain a reduced rate possible (and that we shall plunge higher on the later on in this guide).

W?ho Need to have A renovation Loan?

A house restoration mortgage is best suited for people who find themselves considered nice do it yourself strategies and require financial help to cover the costs. It is perfect for:

- People creating big home improvements: If you are intending tall updates otherwise building work programs which need way too much financial support, a property recovery loan provide the desired money to fund the expense.

- Someone seeking raise property value: Household repair money are beneficial to own people who wish to improve the worth of their property. Through proper developments, including cooking area otherwise toilet improvements otherwise including additional living area, you might boost your residence’s market price.

- The individuals in place of sufficient savings: If you don’t have sufficient offers to invest in your property improvement tactics, a repair mortgage can be connection the fresh new pit. It permits one to accessibility money initial and pay-off them more than date, so it is way more in balance economically.