If you are considering applying for a USDA mortgage for the Georgia, the process concerns coping with a great USDA-accepted financial

To acquire a home is actually a major choice, and sometimes it can feel like brand new documents never closes and you can the brand new economic stress is growing. But here’s what’s promising to have potential homebuyers: USDA funds in Georgia render a means to get a house with little to no deposit called for.

This method are modify-designed for people with smaller earnings staying in rural areas, so it is good for those people trying own a home to the the new borders away from biggest Georgia metropolitan areas or even in a rural area during the state. Geared towards help rural customers, USDA mortgage brokers into the GA are a good selection for previous grads, the latest household, those with reasonable incomes, first-day people, and even those people who have had some borrowing from the bank challenges previously.

What is an excellent USDA Financing?

A beneficial USDA financing , or an outlying Invention Financing, is home financing program work on by the Us Institution out-of Agriculture (USDA) that’s focused on while making homeownership economical for those lifestyle inside outlying elements. USDA funds include glamorous terminology, like reasonable to help you zero advance payment requirements and aggressive appeal cost. This will make them a famous selection for somebody inspect site and you will families having limited financial resources or the individuals seeking to get property in outlying components.

So you can qualify for a great USDA loan, consumers must satisfy certain standards, along with money limitations you to differ in line with the property’s area. While doing so, the home must meet USDA eligibility requirements, such as are situated in an eligible rural urban area as the laid out by the USDA.

These lenders will consider your own eligibility according to things such as for instance earnings, credit rating, and much more. Shortly after recognized, the newest USDA pledges part of the loan, reducing the lender’s chance and you will enabling them to bring advantageous terms and conditions to consumers.

Total, USDA money give anybody and group on the possible opportunity to go homeownership when you look at the outlying section instead of facing tall monetary barriers. This is going to make all of them a very important money to have cultivating financial development in these types of organizations.

USDA Financing Conditions from inside the Georgia

Proper interested in plunge deeper towards the USDA loan requirements from inside the Georgia, it is crucial to understand the simple criteria, such:

- Citizenship: Individuals need provides You.S. citizenship or permanent residence condition, appearing a reliable money and you can an union so you’re able to financing payment.

- Earnings limitations: Potential individuals have to end up in the amount of money thresholds centered because of the USDA, and this are very different predicated on home proportions and you may geographic venue.

- Area requirements: Features have to be receive within qualified outlying portion since the defined by the brand new USDA.

- Lender-particular requirements: If you’re overarching direction are present, loan providers could possibly get impose more stipulations for example lowest credit ratings, debt-to-money percentages (DTI), and you can proof adequate loans to fund closing costs. This type of lender-certain standards verify individuals possess the financial capacity to repay the brand new loan and you will mitigate the new lender’s exposure.

Potential borrowers should look for recommendations off good USDA-acknowledged financial attain understanding of all the standards and you will determine their qualification getting a USDA financing within the Georgia.

Pros and cons off USDA Finance

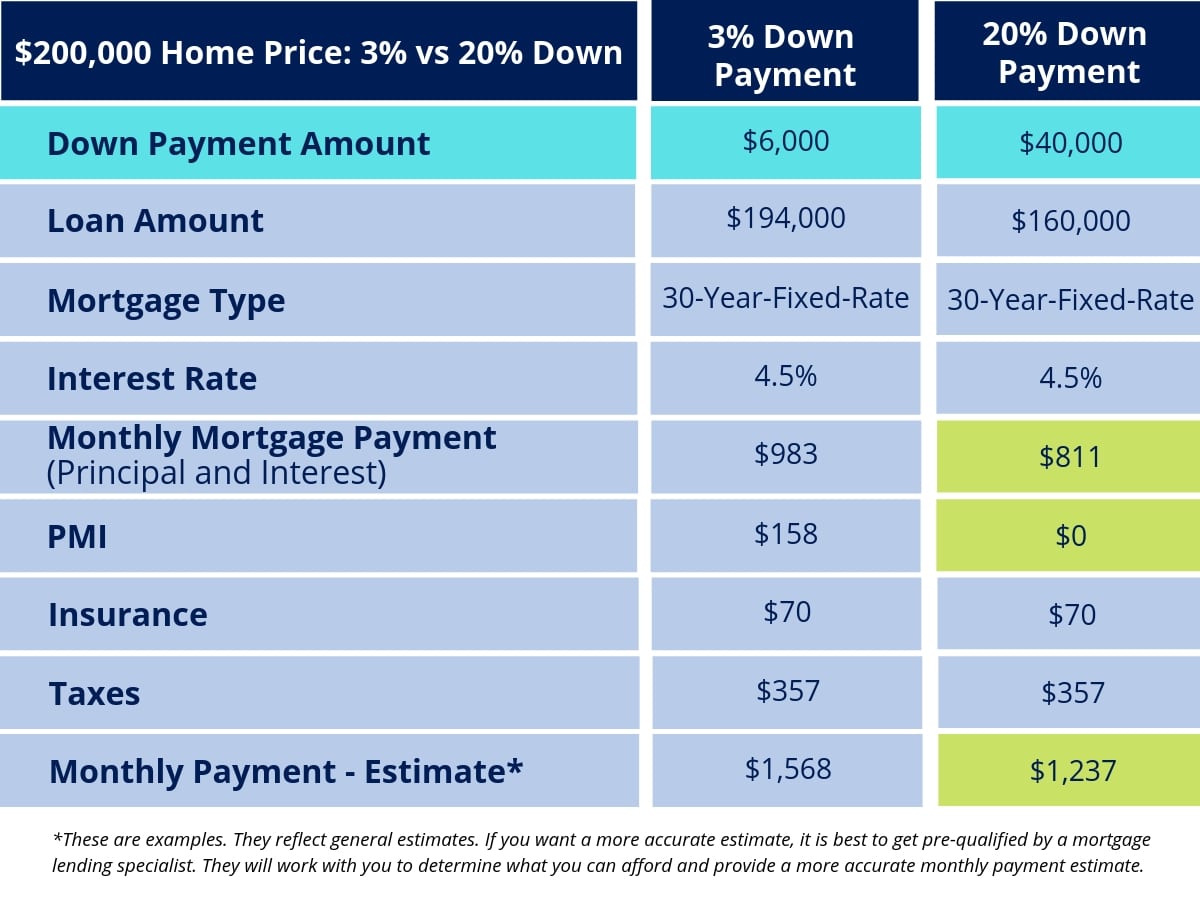

- No down payment needed : Probably one of the most tempting regions of USDA finance is the element for individuals to find a house and no currency off . This somewhat advances option of homeownership, especially for somebody looking to purchase a property having lower income .

- Aggressive interest levels: Supported by the government, USDA funds present reduced exposure to help you loan providers, letting them offer consumers seemingly low interest.

- Versatile credit requirements: USDA money routinely have much more forgiving credit rating requirements as compared to old-fashioned loans, causing them to useful getting consumers with reduced-than-perfect credit histories.

- USDA streamline : The fresh new USDA enjoys a streamline re-finance program of these with current USDA money. When the a reduced rate can be acquired on the market you could would a non-cash-aside price-and-name refinance instead of an assessment, credit review, otherwise earnings files.

- Zero PMI requisite: Rather than extremely antique money, USDA finance do not mandate personal home loan insurance policies (PMI). This can end up in straight down monthly mortgage repayments to possess consumers.

In spite of these demands, USDA funds continue to depict an important method getting potential buyers into the Georgia seeking to sensible homeownership solutions during the outlying components.