Ought i get a fixed rate financial?

But not, with financial pricing soaring over the last seasons, may possibly not be the best time and energy to agree to particularly a lengthy-label offer.

Selecting the right home loan could save you numerous if not thousands of lbs, whether you are to shop for a house or remortgaging. Seeking a loan provider? Read the best lenders.

If you’d like their month-to-month money becoming foreseeable to have a great put while, a fixed speed financial can be sensible.

It offers the new certainty off knowing what your payments will end up being so long as the offer persists. As a result can make it easier to funds and you can function you’ll not get an unexpected statement if interest rates increase.

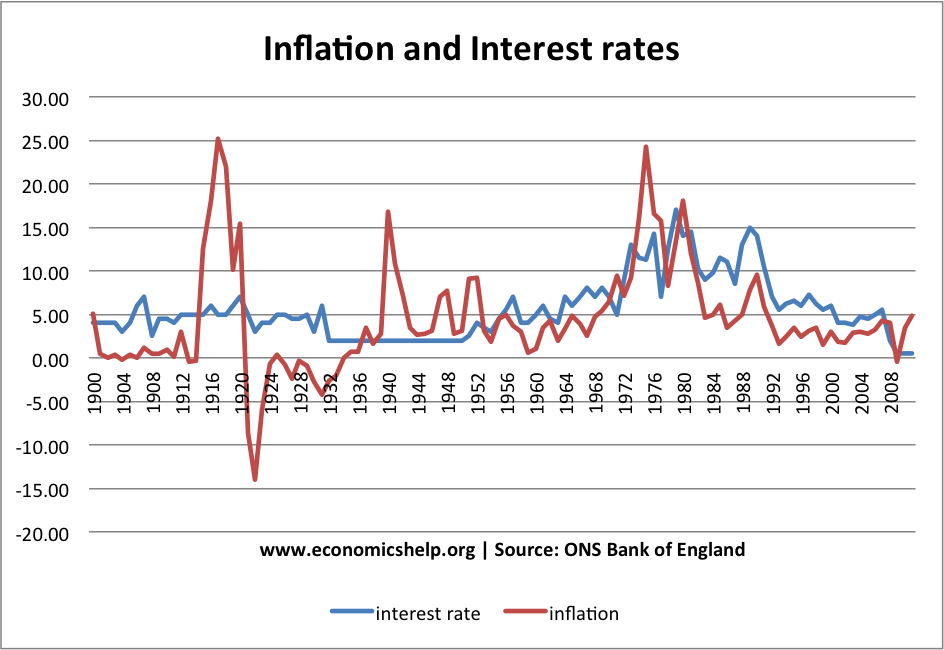

Home loan cost have increased substantially because the . Find out how financial costs has actually changed. However it was best if you protect a beneficial speed today as it’s you are able to they’re going to always wade up.

- Merely decide for a predetermined offer if you are planning to store your home for this amount of time, that’ll usually feel a couple of so you’re able to five years. If you choose to leave prior to your own price stops, you may be stung that have an earlier-fees costs.

- If you were to think you could potentially sell your house till the contract concludes, it’s probably wii tip so you can choose a longer-term one.

Try a basic changeable rate home loan advisable?

The SVR is the lender’s default rates. It’s always much more expensive than simply choosing a fixed price otherwise tracker bargain, so it is impractical becoming your best option.

People do not constantly sign up for a fundamental variable rate mortgage. Usually might roll on the SVR instantly when the the repaired contract has expired. That’s, if you don’t plan another type of price before their dated you to definitely elapses.

While you are nearby the prevent from a deal, you could steer clear of the SVR by the remortgaging alternatively, or by the using another type of mortgage with the same bank, named something import. Find out more about whether or not now is a good time so you can remortgage.

Was guarantor mortgages sensible?

A guarantor financial functions providing a daddy or some other friend so you’re able to consent to fund their home loan repayments should you not manage to cause them to become.

With that be certain that positioned, you might be capable acquire much more for taking brand new first rung on the ladder on the possessions steps that have a small put.

This can be a solution to consider in the event that, say, you simply have a little into the savings, or if you enjoys a low-income, or perhaps not much credit score.

However you need to go towards the such an arrangement which have caution; for folks who get behind on costs, your family will be required to pay for them. This is certainly an enormous commitment to generate.

Before signing upwards, think carefully from the if a great guarantor mortgage suits you. Read more in the buying payday loan Lafayette your earliest household or other let one to might be available.

In the event that you pull out a long-name home loan?

The fresh new lengthened the borrowed funds term, the reduced the monthly costs. This may cause you to hotter economically monthly as you pay it off.

Although not, discover drawbacks in order to taking right out an extremely-much time mortgage whilst usually takes your decades to pay it off and this will charge a fee a whole lot more about long manage. The reason being you may be paying interest for extended.

In contrast, the fresh reduced the borrowed funds identity the fresh reduced you pay off of the financial and completely own your property. However your own monthly repayments was larger, so it’s crucial that you make sure to usually do not more-increase your self.